Double Entry

Double-entry accounting is a method of bookkeeping that records each financial transaction in two or more accounts. It is used to maintain accurate records of a company’s financial activities and helps to ensure that the accounting records are balanced.

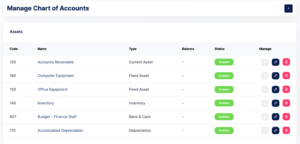

Chart of Accounts

A chart of accounts is a list of all the accounts used in the accounting system. It is used to organize financial transactions and to group similar accounts together. The chart of accounts provides a framework for the financial statements and helps to ensure that financial transactions are properly recorded.

Use Case

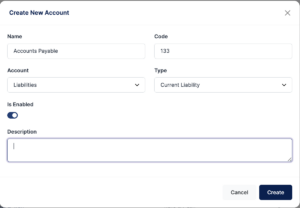

If you want to create/access the chart of accounts, you can do so using the following steps:

Instructions

- Go to the “Chart of Accounts” section in the accounting module.

- Click on the “New Account” button to create a new account.

- Fill in the account details, such as account name, account number, account type, and description.

- Click on the “Save” button to save the new account.

- To edit an existing account, click on the account name and make the necessary changes. Click on the “Save” button to save the changes.

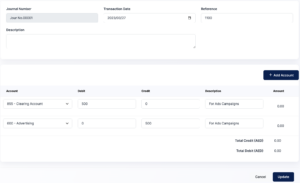

Journal Account

A journal account is a record of all financial transactions in chronological order. It is used to track all the debits and credits made to each account and provides a complete history of the financial transactions.

Use Case

If you want to access the journal account, you can do so using the following steps:

Instructions

- Go to the “Journal Account” section in the accounting module.

- Click on the “New Entry” button to create a new journal entry.

- Fill in the details of the transaction, such as the date, account name, amount, and description.

- Click on the “Save” button to save the journal entry.

- To edit an existing journal entry, click on the entry and make the necessary changes. Click on the “Save” button to save the changes.

Ledger Summary

A ledger summary is a report that summarizes the financial transactions recorded in the ledger. It provides an overview of the account balances and helps to ensure that the accounting records are accurate and up to date.

Use Case

If you want to access the ledger summary, you can do so using the following steps

Instructions

- Go to the “Ledger Summary” section in the accounting module.

- Select the account you want to view the ledger summary for.

- The ledger summary will display the opening balance, the total debits, the total credits, and the closing balance for the selected account.

Balance Sheet

A balance sheet is a financial statement that reports a company’s assets, liabilities, and equity at a specific point in time. It provides a snapshot of a company’s financial position and helps to assess its financial health.

Use Case

If you want to view the balance sheet, you can do so using the following steps:

Instructions

- Go to the “Balance Sheet” section in the accounting module.

- Select the date range for the balance sheet you want to view.

- The balance sheet will display the assets, liabilities, and equity of the company as of the selected date.

Trial Balance

A trial balance is a report that lists all the accounts in the ledger and their balances. It is used to ensure that the total debits and credits in the accounting system are equal and that the accounting records are accurate.

Use Case

If you want to view the trial balance, you can do so using the following steps:

Instructions

- Go to the “Trial Balance” section in the accounting module.

- The trial balance will display the name of the account and its balance.

- The total debits and credits will be displayed at the bottom of the report.